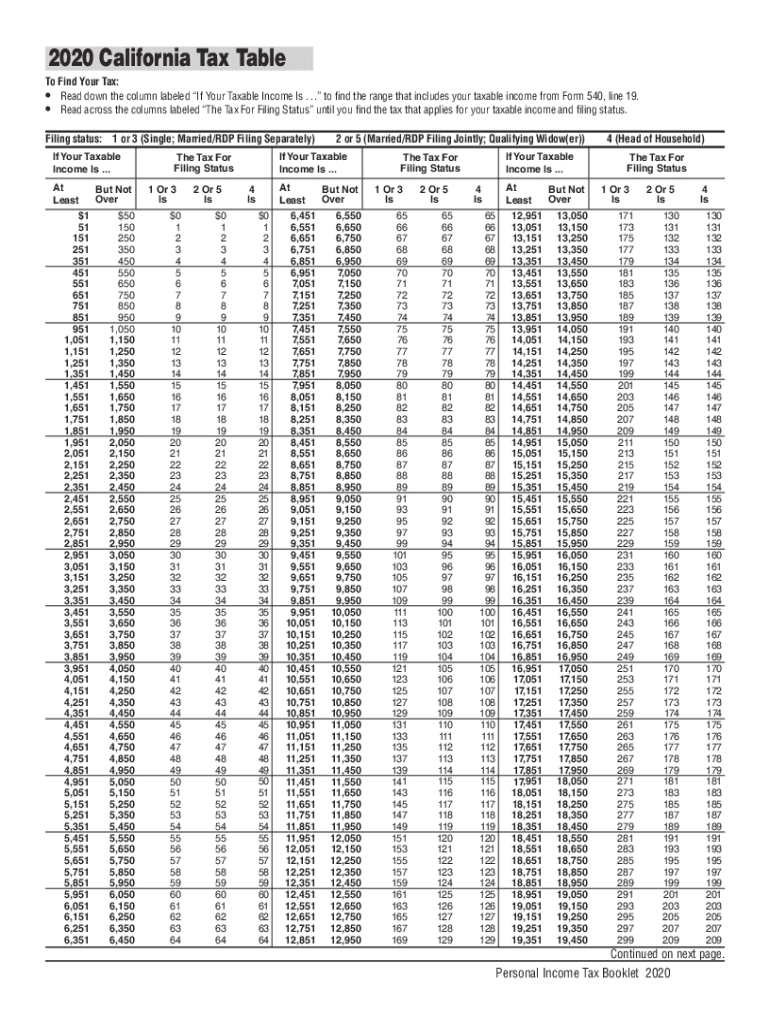

Franchise Tax Board Tax Tables 2025. • read down the column labeled “if your taxable income is. The income tax laws permit such transitions. 1 percent to 12.3 percent.

Blocks us labor board rule on contract and franchise workers march 9, 2025. California has nine tax brackets, ranging from 1 percent to 12.3 percent.

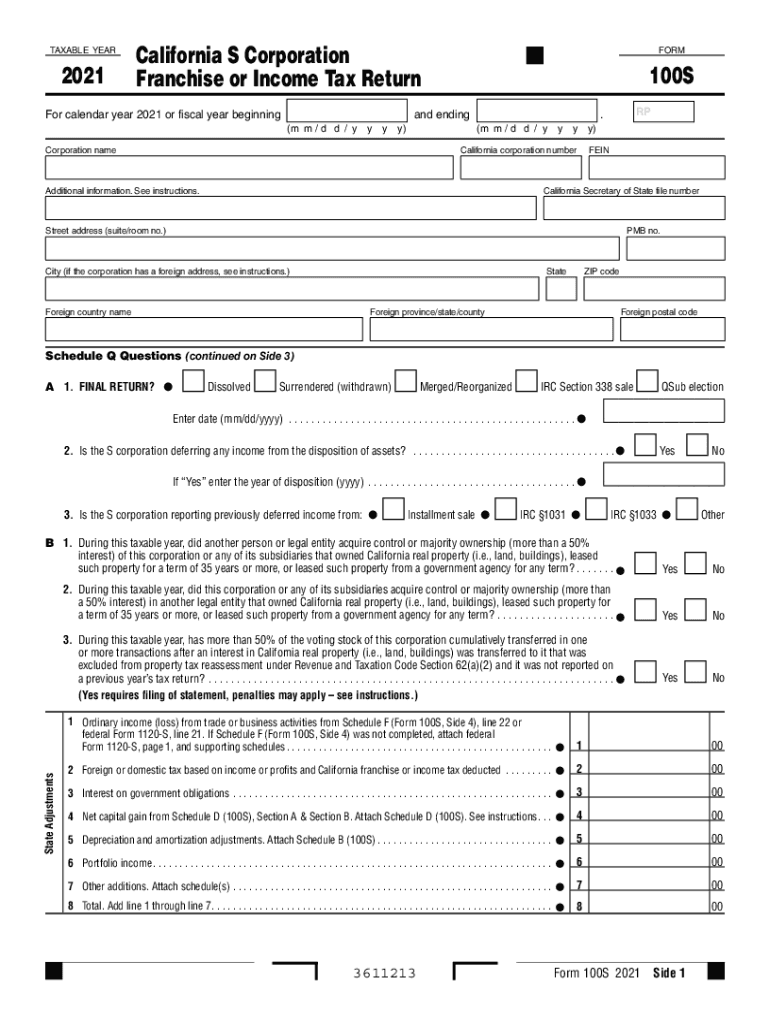

Ca Franchise Tax Board 20212024 Form Fill Out and Sign Printable PDF, Do not include dollar signs ($), commas. • read down the column labeled “if your taxable income is.

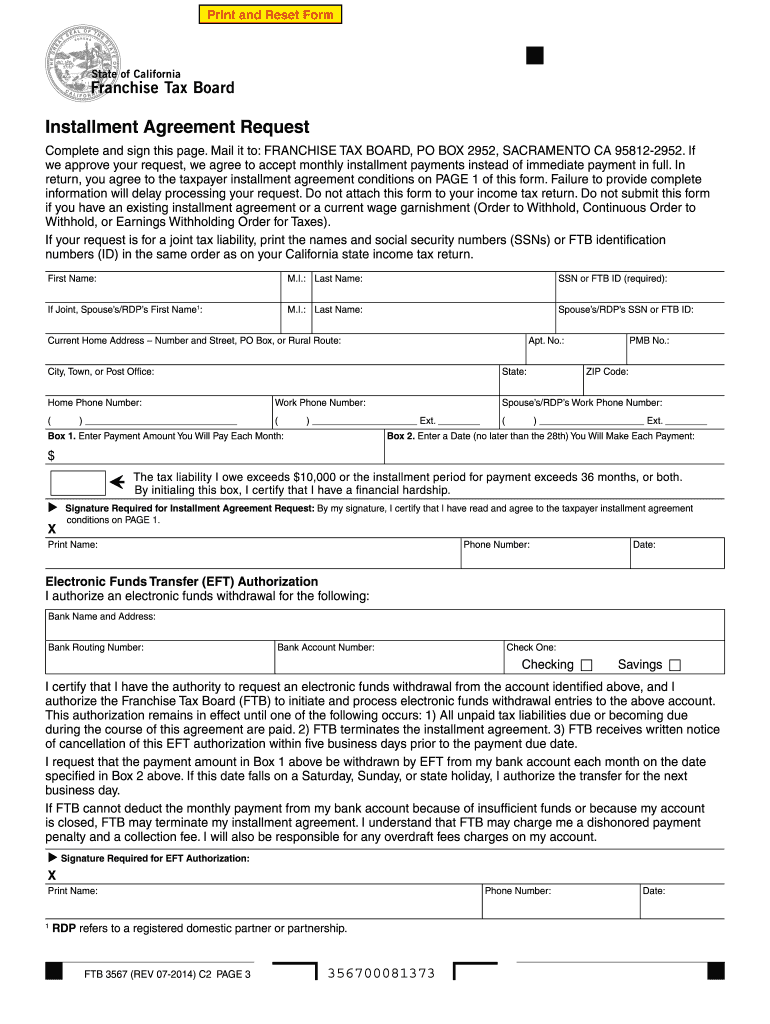

Ca franchise board tax Fill out & sign online DocHub, Tax news is a monthly online publication to inform tax professionals, taxpayers, and business owners about state income tax laws, franchise tax board (ftb) regulations,. California provides two methods for determining the amount of wages and salaries to be withheld for state personal income tax:

Tax rates for the 2025 year of assessment Just One Lap, The federal income tax has seven tax rates in 2025: Individuals who are required to make estimated tax.

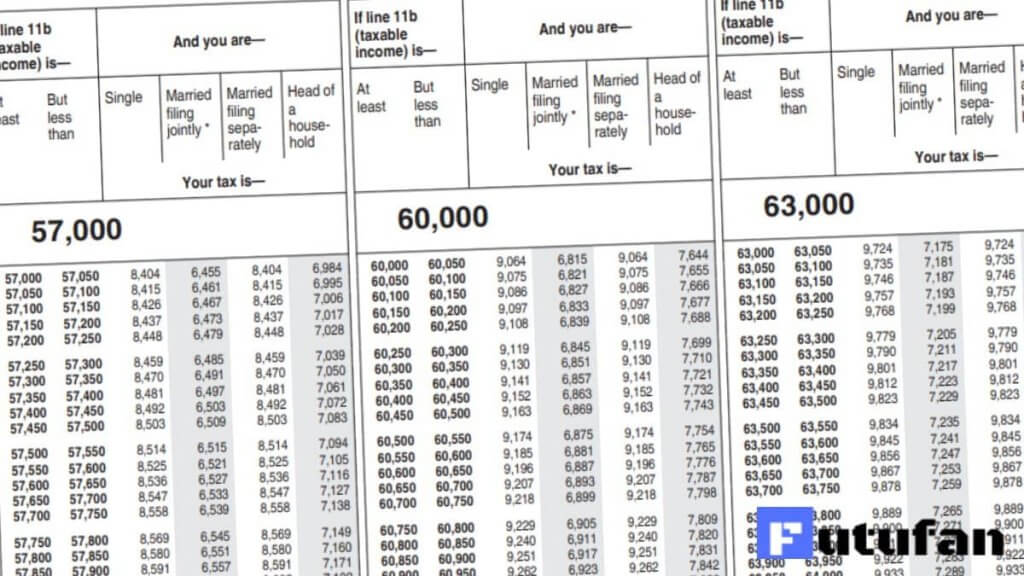

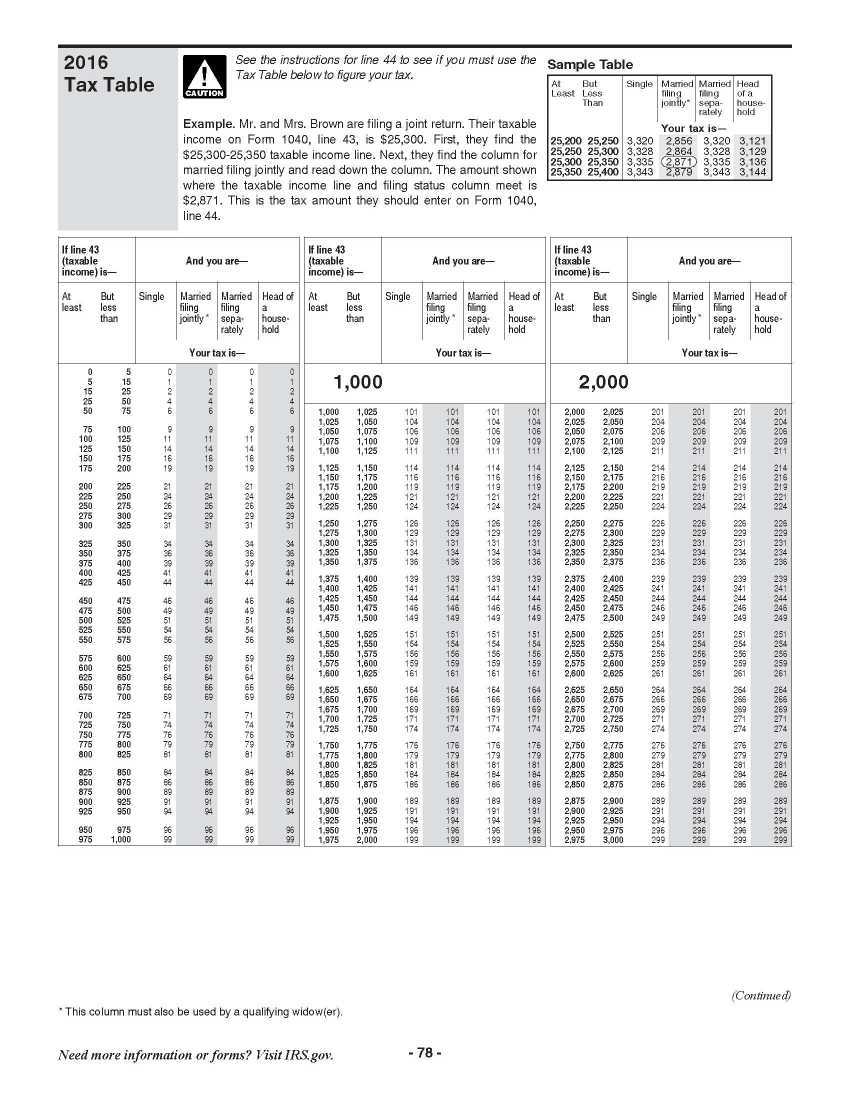

Federal Withholding Tables 2025 Federal Tax, .” to find the range that includes your taxable income from form. If your taxable income was $100,000 or less, use the tax table on the california franchise tax board's website to figure taxes owed instead.

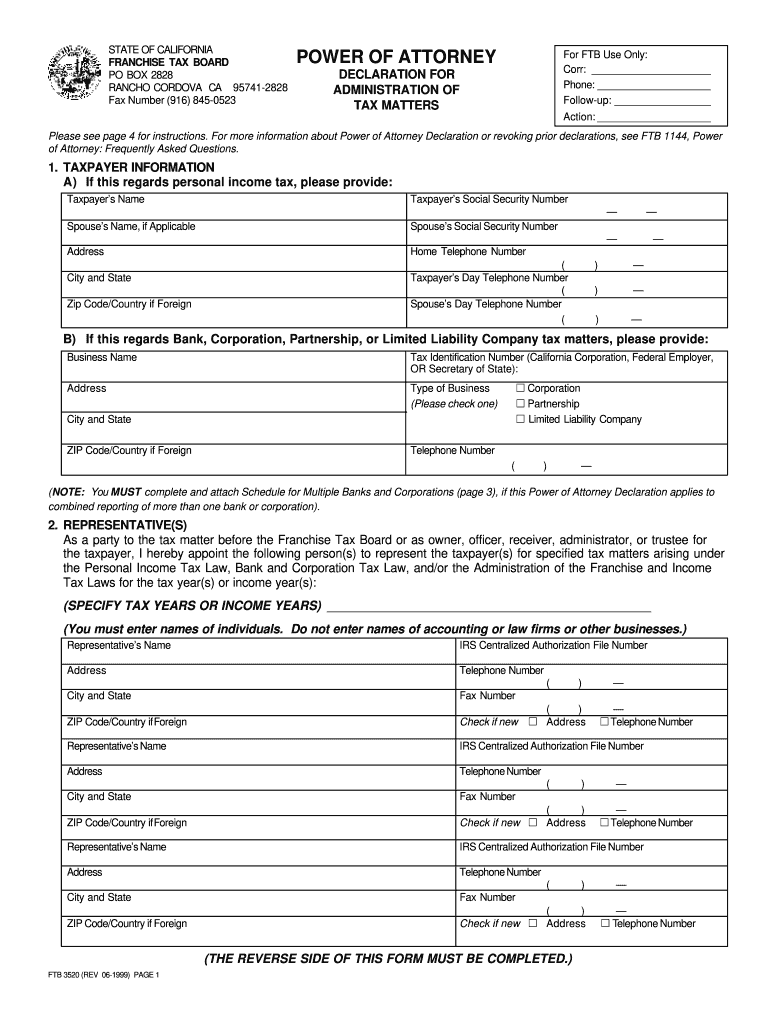

Franchise Tax Board 20142024 Form Fill Out and Sign Printable PDF, Single | joint | head of household; Jpmorgan chase and wells fargo bought tables.

Maximize Your Paycheck Understanding FICA Tax in 2025, Single | joint | head of household; California has nine tax brackets, ranging from 1 percent to 12.3 percent.

IRS Tax Tables 2025 2025, Jpmorgan chase and wells fargo bought tables. This calculator does not figure tax for form 540 2ez.

IRS EZ Tax Table 2025 2025 EduVark, This form is for income earned in tax year 2025, with tax returns. The top marginal income tax.

BpH Wealth Tax Tables 2025/2025 BpH, Form 540 and 540 nr; 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent.

Tax board Fill out & sign online DocHub, File your tax return for 2025 on or before march 3, 2025, and pay the total tax due. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent.